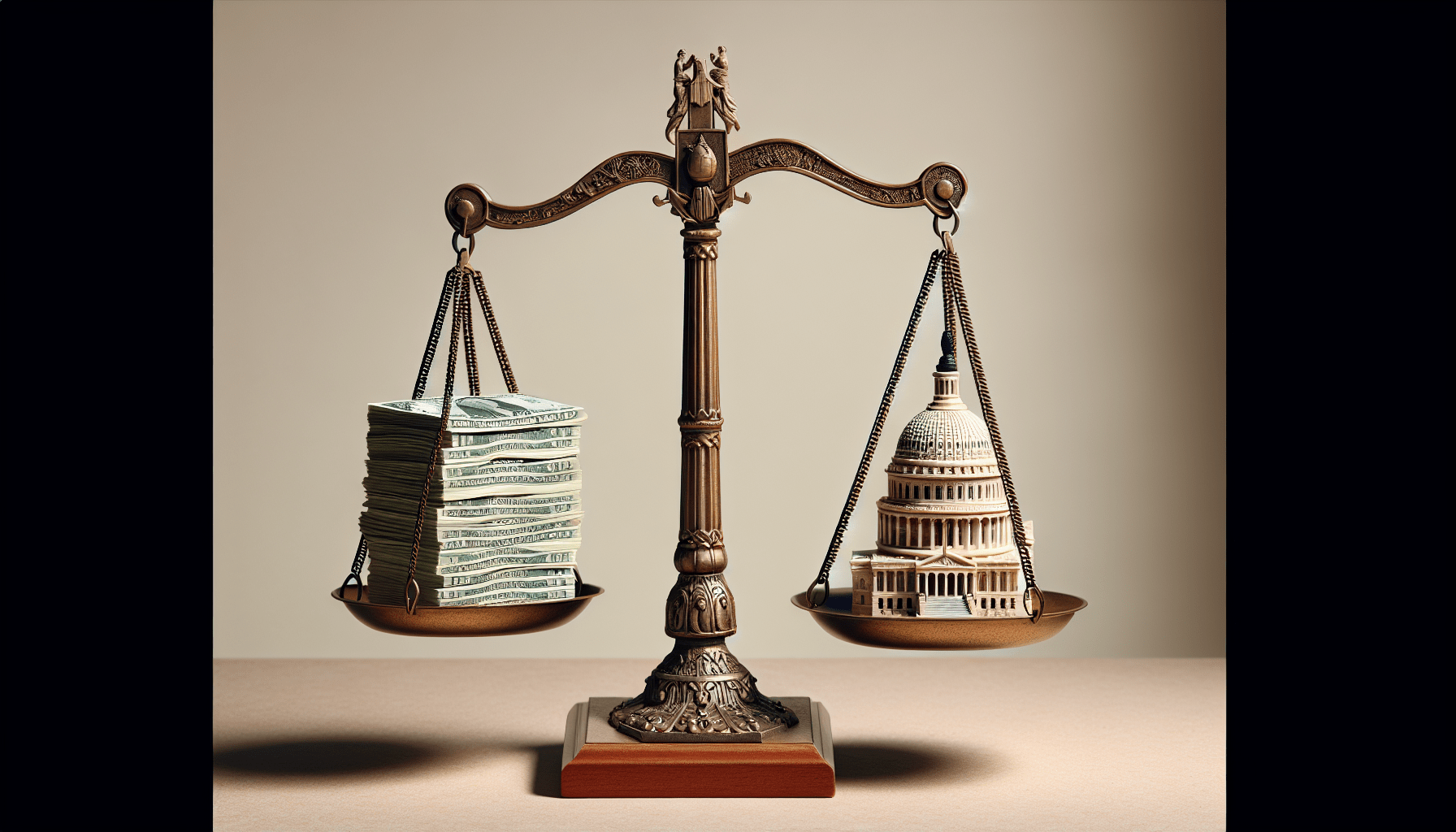

In “What Happens When The US Borrows Money?” you will discover the intriguing journey of how the United States government manages its finances through borrowing. You’ll learn about the mechanisms behind issuing government bonds, the role of the Federal Reserve, and the impact this borrowing has on the economy, both domestically and globally. This article demystifies the complexities of national debt and explains how it can influence everything from interest rates to inflation. Get ready to gain insights into the ripple effects that government borrowing has on your everyday life and the broader economic landscape. Have you ever wondered what happens when the US borrows money?

It’s a fascinating question that delves into the complexities of economics, government finance, and global markets. It’s not just about numbers; it’s about understanding the ripple effects on the economy, your pocket, and even international relations. Let’s break down this intricate process and explore the various facets of what happens when the US decides to borrow money.

Understanding National Debt

What Is National Debt?

National debt, often referred to as sovereign debt, is the total amount of money that a country’s government has borrowed. Imagine it as the tab the government runs up, just like when you owe money on your credit card.

How Does the US Borrow Money?

The US borrows money primarily by issuing Treasury securities – these are bonds, bills, and notes. Investors purchase these securities, lending money to the government in exchange for periodic interest payments and the return of the face value upon maturity.

| Security Type | Duration | Interest Payment Frequency |

|---|---|---|

| Treasury Bills | From a few days up to 1 year | None (sold at a discount) |

| Treasury Notes | 2 to 10 years | Semiannually |

| Treasury Bonds | 20 to 30 years | Semiannually |

Why Does the US Borrow Money?

You might wonder why a powerful economy like the US needs to borrow money. The reasons are multifaceted:

- Deficit Financing: When government expenditures exceed its revenues, it borrows to cover the gap.

- Stimulating Economic Growth: Borrowing can fund infrastructure projects, research, and other investments that spur long-term growth.

- Crisis Management: During emergencies like wars, natural disasters, or economic recessions, borrowing provides the necessary funds to manage the situation effectively.

The Ripple Effect on the Economy

Impact on Interest Rates

When the government borrows heavily, it can influence interest rates. More borrowing can lead to higher interest rates because the government competes with the private sector for available funds, driving up the cost of borrowing.

Inflation Considerations

Borrowing can also affect inflation. If the government pumps too much money into the economy without corresponding growth in goods and services, prices can rise, leading to inflation. It’s a delicate balance that policymakers must maintain.

Public vs. Private Investment

Another ripple effect involves the crowding-out theory. This suggests that massive government borrowing can crowd out private investment by making loans more expensive for businesses. When businesses borrow less, it can slow down economic growth.

The Global Perspective

Foreign Investors

A significant portion of US debt is held by foreign investors, including governments and individuals. This reflects the global trust in the US economy but also creates dependencies and vulnerabilities.

International Relations

Borrowing can also influence international relations. High levels of debt held by foreign governments can lead to strategic leverage. For example, if China holds a substantial portion of US debt, it could theoretically exert some influence over US policy decisions.

Currency Valuation

Heavy borrowing can impact the US dollar’s value on the global stage. When confidence in the economy is high, the dollar remains strong. However, massive debt without corresponding economic growth can lead to a weaker dollar, affecting everything from import prices to global financial stability.

The Good, The Bad, and The Ugly

The Good: Economic Growth

Borrowing isn’t inherently negative. When used wisely, borrowed funds can stimulate economic growth, create jobs, and improve infrastructure. This is especially important during downturns when private investment wanes, and government intervention is crucial.

The Bad: Rising Deficits

However, there’s a downside. Constant borrowing leads to rising deficits and long-term debt. If not managed properly, this can limit future government spending abilities and place a burden on future generations.

The Ugly: Default Risk

In extreme cases, excessive borrowing can lead to default risk – the chance that the government might fail to meet its debt obligations. While the US is considered low-risk, the mere threat can destabilize financial markets and the economy.

Policy Responses and Management

Fiscal Policies

The government employs various fiscal policies to manage debt. This includes tax policies, spending controls, and occasionally, austerity measures to rein in deficits.

Monetary Policies

On the flip side, the Federal Reserve plays a crucial role through monetary policy. Adjusting interest rates, controlling money supply, and other tools help manage economic stability and inflation, indirectly impacting the debt situation.

| Tool | Description |

|---|---|

| Adjusting Interest Rates | Changes cost of borrowing for both government and private sector |

| Controlling Money Supply | Manages inflation and economic growth |

| Open Market Operations | Buying/selling government securities |

Debates and Discussions

There are ongoing debates about the best ways to manage national debt. Some advocate for more aggressive tax reforms, while others emphasize the need for controlled government spending. The debates are complex, with valid arguments on both sides.

Personal Implications

Taxes

High national debt can lead to higher taxes in the future. To pay off debt, the government may increase income, sales, and other taxes, directly impacting your wallet.

Social Programs

Debt can also affect the funding of social programs. Education, healthcare, and social security could face cuts to balance the budget, affecting your access to these essential services.

Interest Rates on Personal Loans

Remember how national borrowing affects interest rates? This trickles down to your mortgage, car loans, and credit cards. Higher national debt can result in higher interest rates for consumers, making borrowing more expensive.

How Does It Compare to Other Countries?

Comparative National Debt

It’s useful to compare the US debt situation with other countries to gain perspective. Some nations have higher debt-to-GDP ratios, while others maintain much lower levels of borrowing.

| Country | Debt-to-GDP Ratio (%) |

|---|---|

| Japan | 266 |

| Greece | 210 |

| United States | 125 |

| Germany | 70 |

Lessons Learned

Looking at global examples, you can see that the management and implications of national debt vary widely. Nations like Japan manage high debt through internal borrowing, while Greece faced severe economic challenges and austerity measures due to its debt crisis.

Moving Forward: Sustainable Debt Management

Balancing Act

The key to sustainable debt management lies in balancing borrowing with economic growth. Governments must ensure that borrowed funds contribute to GDP growth, making it easier to repay debt without burdening future generations.

Innovation and Efficiency

Investing in innovation and efficient public spending can turn borrowed funds into growth catalysts. Infrastructure, education, and technology are critical areas where wise investment can yield significant economic returns.

Accountability and Transparency

Finally, robust accountability and transparency in government spending are essential. Citizens and policymakers alike need clear, truthful information about debt levels, spending, and economic impacts to make informed decisions.

Conclusion

So, what happens when the US borrows money? It sets off a complex chain of events that reverberates through the economy, affects global markets, and touches your everyday life. By understanding the intricacies of national debt, you can appreciate the balancing act that policymakers face in managing this essential aspect of economic governance. Whether it’s stimulating growth in tough times or ensuring long-term sustainability, the art of borrowing and repaying money is a fundamental part of the economic landscape.

By staying informed and engaged, you can better navigate the personal and broader implications of national debt. Remember, while borrowing is a powerful tool, its effective management is key to ensuring a stable and prosperous future.