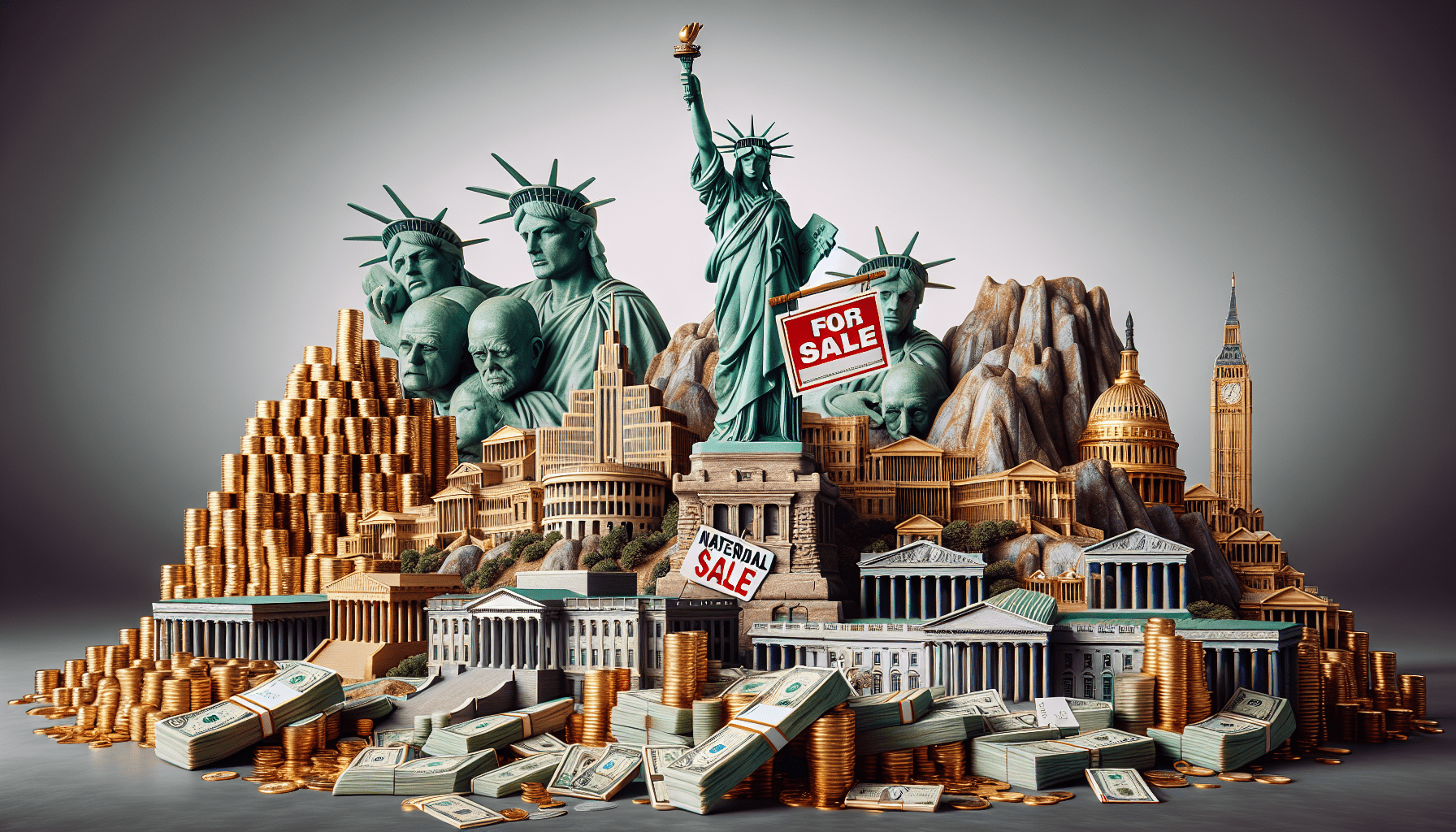

Ever wondered why the United States doesn’t just sell off its assets to pay down its hefty national debt? At first glance, it might seem like a straightforward solution, but there are key reasons why this approach is far from simple. The complexities of asset valuation, economic stability, and political feasibility all play significant roles. This article explores these intricacies, shedding light on the balancing act of maintaining national wealth while managing financial obligations.

Why Doesn’t The US Pay Off Its Debt By Selling Assets?

Introduction

Have you ever wondered why the United States doesn’t just sell off some of its numerous assets to pay down its staggering national debt? It seems like such a straightforward solution at first glance. However, the issue is far more complex than it appears. In this article, we’ll dive into why the U.S. doesn’t simply liquidate its assets to settle its debts and explore the intricacies of national financial management.

Understanding National Debt

What Is National Debt?

National debt is the total amount of money that a country owes to creditors. These creditors can be either domestic or foreign and include entities ranging from private individuals to international organizations. National debt accumulates over time when a government continually spends more money than it receives.

Components of U.S. National Debt

The U.S. national debt is divided into two main categories:

- Public Debt: Debt held by the public includes Treasury securities such as bills, notes, and bonds owned by individuals, businesses, and foreign governments.

- Intragovernmental Holdings: Debt held by federal government accounts, primarily trust funds like Social Security.

Current Debt Figures

As of recent estimates, the U.S. national debt approaches $33 trillion, a staggering number that keeps climbing. This amount includes both public debt and intragovernmental holdings.

| Category | Amount (Trillions USD) |

|---|---|

| Public Debt | Approx. $23 Trillion |

| Intragovernmental Debt | Approx. $10 Trillion |

| Total | Approx. $33 Trillion |

U.S. Assets: What Could Be Sold?

Government-Owned Land

The U.S. federal government owns nearly 28% of the country’s land, approximately 640 million acres. This land includes national parks, forests, and mineral reserves.

Buildings and Infrastructure

The government also possesses an extensive portfolio of buildings and infrastructure, including federal buildings, military installations, highways, dams, and more.

Natural Resources

The U.S. has substantial reserves of natural resources, including oil, gas, coal, and minerals. These assets are crucial for energy production and industrial activities.

Intellectual and Cultural Assets

Projects such as NASA’s space exploration programs, patents, and copyrights generated by federal investments also represent valuable but less tangible assets.

Challenges of Selling National Assets

Value Assessment

Determining the fair market value of government assets is not straightforward. For example, how do you appraise the worth of a national park, which provides not just monetary value but also ecological, recreational, and cultural benefits?

Market Readiness

Not all assets are easily liquidated. For instance, there might not be a significant market for certain military installations or specialized federal buildings.

Strategic and Security Concerns

Selling strategic assets like military bases or critical infrastructure could jeopardize national security. Similarly, privatizing natural reserves or energy resources might reduce the nation’s long-term self-sufficiency.

Public Resistance

Public opposition to selling national treasures like Yellowstone National Park or the Smithsonian Institution could be intense. These assets hold significant cultural and emotional value for many Americans.

Economic Ramifications

Temporary Solution

Selling assets is a one-off solution and doesn’t address the underlying fiscal imbalance between government spending and revenue. It would be like selling your house to pay off credit card debt without changing your spending habits.

Impact on Revenue Streams

Many government assets generate steady revenue. For example, national parks earn money through entrance fees, and mineral extractions yield royalties. Selling these assets could reduce future income.

Inflationary Pressures

Large-scale asset sales could flood the market with supply, driving down prices and potentially leading to inflationary pressures. This could destabilize the economy further.

Public Debt Cycle

Even if a significant portion of the debt was paid off through asset sales, the government would still likely continue borrowing to finance ongoing expenditures. This can perpetuate the debt cycle.

Alternative Solutions

Tax Reforms

One way to reduce the national debt is through comprehensive tax reform. This could involve closing loopholes, adjusting tax rates, and broadening the tax base.

Spending Cuts

Reducing government expenditures can also help balance the budget. However, this approach often faces significant political resistance because it may involve cutting popular programs.

Economic Growth

Stimulating economic growth can increase tax revenues without raising tax rates. This can help reduce the budget deficit and, by extension, the national debt.

Public Awareness and Participation

Educating the public on the complexities surrounding national debt and involving them in finding sustainable solutions can be instrumental. A well-informed electorate can push for policies that address long-term fiscal imbalances.

Case Studies

Greece

In the wake of the 2008 financial crisis, Greece faced massive national debt and opted to sell state assets as part of its bailout conditions. The results were mixed, and while some debt was alleviated, economic and social challenges persisted.

Argentina

Argentina has faced repeated debt crises and has occasionally sold state assets to manage its debt. However, these sales were often accompanied by economic instability, highlighting the challenges and risks involved.

| Country | Strategy | Outcome |

|---|---|---|

| Greece | Asset sales | Mixed results; some debt alleviated but continued economic and social challenges |

| Argentina | Asset sales and restructuring | Periodic relief but often accompanied by economic instability |

Summary

Complexity and Risks

The notion of paying off national debt by selling assets seems simple, but it’s fraught with complexities and risks. Assets can be difficult to value, hard to sell, and strategically important to retain.

Alternative Solutions

Sustainable solutions like tax reforms, spending cuts, and stimulating economic growth may offer more viable, long-term ways to address national debt.

Public Awareness

Ultimately, fostering a well-informed public that understands the complexities of national debt and supports thoughtful, comprehensive policies can be crucial in addressing this pressing issue.

Conclusion

The U.S. national debt is a multifaceted issue that cannot be resolved merely by selling off assets. While liquidating assets might seem like a quick fix, the long-term consequences and practical difficulties make it an impractical solution. Instead, a combination of robust fiscal policies, public awareness, and sustainable economic strategies will be required to address this perennial issue effectively.

Thank you for joining me in this exploration of why the U.S. doesn’t pay off its debt by selling assets. Hopefully, this article has provided a more nuanced understanding of the complexities involved. What do you think? Are there other solutions you would consider? Feel free to share your thoughts!